By now you should have a good idea of the general parameters of medical billing. In order to review for the quiz, we’ll go back through this section and touch on some of the most important aspects of the medical billing process. Use this review to study for the Section 3 Quiz, and go back over the Medical Billing Vocabulary Course to sharpen your skills.

Who Participates in Medical Billing

Medical billing is the process of ensuring a provider is paid for their services. In the healthcare process, there are three principal parties: the patient, the provider, and the payer.

The patient is the person receiving medical services.

The provider is the healthcare facility, doctor, physician, or practice that administers the medical services.

The payer can be a health insurance company, organization, or government agency (like Medicare or Medicaid) that reimburses the provider for their services, so long as the patient has a contract or agreement with the payer.

The medical biller acts as a sort of financial conduit between these three parties, ensuring that the provider is reimbursed by the payer for the services it (the provider) performed on the patient.

The Medical Billing Process

Let’s look at this another way: the patient has an agreement with the payer (let’s say it’s a Health Maintenance Organization, or HMO) that provides that patient, or subscriber, with health insurance. That patient comes down with the flu and goes to see the doctor (provider). The provider diagnoses the flu in the patient and prescribes some medication.

The provider has now provided medical services to the patient, and needs to be reimbursed. The provider’s office generates a medical report, which is then coded (by the medical coder) and transferred to the biller. The biller looks at the patient’s insurance agreement with the payer (the patient’s HMO) and figures out how much the payer is contractually obligated to pay the provider.

The biller puts the diagnosis codes, procedure codes, patient information, provider information, and cost of the procedures into a document called a claim. This claim can be manual (paper) or electronic. Today, most billers send claims electronically.

The biller sends the claim to the payer, who then evaluates (“adjudicates”) it, and decides whether they will approve, deny, or reject the claim. In many cases, a biller will send the claim, or information to create the claim, to a clearinghouse, which is a third-party organization that specializes in creating error-free, or “clean,” claims. Creating clean claims is imperative, because if a claim is returned with errors, it may take more time to correct and re-process.

If the claim is approved, it’s sent back to the biller with an explanation of what, and how much of, each procedure the payer will pay for. The biller subtracts that number from the total cost of the procedure and comes up with the balance. The balance is then passed on to the patient, who is responsible for the remainder of the balance.

The above is fairly simplified version of the medical billing process. There are a number of caveats and complications that can arise in the process of creating a health care claim, and many of them stem from the way payers interact with patients and providers.

More About Insurance

Different levels of coverage, different deductibles, and different kinds of coinsurance or co-pay arrangements all play large parts in how we create claims.

The most basic type of insurance is indemnity insurance. Under this kind of insurance, a subscriber (the patient) can go to any provider they wish. Indemnity insurance typically has higher premiums (the monthly or annual membership fees charged by the insurance company) and deductibles, but offers patients more flexibility.

A deductible is the amount of money a patient must pay before their insurance coverage kicks in. For example, if a patient has a $200 deductible and receives a $600 medical procedure, that patient has to pay the $200 before the payer will cover the cost of the medical service.

Managed care is a larger, more popular type of insurance. In managed care, certain restrictions are placed on what providers the patient may see, in exchange for lower premiums and deductibles. The most popular types of managed care are the Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Point-of-Service (POS), and Consumer-Driven Healthcare Plans (CDHP).

With an HMO, a patient must see a provider within a prescribed network. Seeing an out-of-network provider will not be covered by the HMO. In a PPO, patients are allowed to see any provider, but will pay less if they see a provider in a certain (“preferred”) network. With a POS model, a subscriber typically receives most of the care in-network, but can see an out-of-network physician if they pay a higher fee, making it much like a PPO.

Finally there is the Consumer-Driven Healthcare Plan (CDHP). CDHPs allow patients to receive PPO-like benefits after they’ve paid a certain (high) deductible. A “savings account” is included in the CDHP, which allows subscribes to save up untaxed earnings to pay for future healthcare. In general, the CDHP is designed to give consumers (that is, subscribers/patients) more control over their healthcare coverage.

While many of these insurance plans differ, they each have similar mechanics. Those include premiums and deductibles (both of which we just discussed) and co-pays and coinsurances.

A co-pay is a small amount that the subscriber must pay before any medical service is rendered. The amount for a co-pay is fixed and depends on what type of medical procedure is performed.

A coinsurance, on the other hand, is a type of arrangement between the payer and patient/subscriber which breaks down the amount owed by the payer along a percentage. An example would be a 70-30 coinsurance. In this agreement, the payer owes 70% of the medical expense, while the patient/subscriber must pay the other 30%. The payer is always listed first in the coinsurance.

So how does this affect medical billing? When we create claims, we include the cost of the total procedure in the claim we send the payer. Each insurance plan features deductibles, copays, and/or coinsurances. This means that the amount a biller sends to a payer will differ based on each patient’s insurance plan.

Let’s look at a brief example. A patient receives a $800 medical procedure. The patient has an insurance plan with a 70-30 coinsurance and a $200 dollar deductible. In order to properly bill for this procedure, we’d first subtract the deductible from the $800, giving us $600. We’d then divide that $600 into portions of 70% and 30%. Under this agreement, we’d bill the payer for $420, and we’d bill the patient for $180.

Medicare & Medicaid

Many people in the United States receive their health insurance coverage from the large, government-funded payers known as Medicare and Medicaid.

Medicare is a social insurance program designed to help elderly people and individuals with certain disabilities and diseases pay for their health care. American citizens over the age of 65, who have registered for Social Security are eligible for Medicare coverage, along with people with Lou Gehrig’s disease or end-stage renal failure.

Medicare is divided into four main parts, each of which covers a certain type of healthcare. Part A of Medicare covers medically necessary health services like hospital stays and treatment at inpatient facilities. Part B covers other necessary services, and also extends coverage for preventive services and general health maintenance.

Part C, also known as the Medicare Advantage, allows subscribers to receive private insurance, which is then funded by the government. Part D covers prescription drug costs. Parts A and B together make up what’s known as Original Medicare, which is still the most common type of Medicare coverage.

Medicaid is a government program that provides healthcare coverage to poverty-stricken individuals and families, along with disabled persons. Unlike Medicare, which is run by the federal government, Medicaid differs from state to state. Each state has to meet certain minimum requirements for coverage, but there is no universal Medicaid plan.

Both Medicare and Medicaid require claims to be submitted in a certain format. The manual version of this form is the CSM-1500. This form has a digital equivalent, as well. Billers always send claims directly to Medicare and/or Medicaid, bypassing any clearinghouses.

HIPAA

The government has acknowledged and standardized electronic claims through the Health Insurance Portability and Accountability Act (HIPAA). This act does a number of things in addition to regulating electronic medical transactions.

HIPAA…

- Protects the insurance coverage of workers after they lose or change their job

- Protects the privacy of patients’ medical information

- Establishes standards for electronic medical transactions

- Sets up rules and punishments for fraudulent medical reporting practices

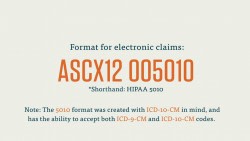

HIPAA, in fact, standardized medical codes and established the Electronic Data Interchange (EDI) form that we use to send claims electronically. This EDI, called ASC X12, has a number of types, each of which corresponds to a certain type of transaction between (typically) a provider and a payer.

HIPAA also sets standards for how providers interact with and store the information of their patients.

Now that you’ve come this far, it’s time to try the quiz!