By now you have a good idea about the practice of medical coding. But we still don’t know much about what those codes are used for.

While it’s true that we can use diagnosis and procedure codes to track the spread of disease or the effectiveness of a particular procedure, their main use in the United States is in the reimbursement process. In other words, codes help us bill accurately and efficiently.

Let’s take a closer look at why we bill.

Why we bill

Going to the doctor may seem like a one-to-one interaction, but in reality it’s part of a large, complex system of information and payment. While the insured patient may only have direct interaction with one person or healthcare provider, that check-up is actually part of a three-party system.

The first party is the patient. The second party is the healthcare provider. The term ‘provider’ includes hospital, physicians, physical therapists, emergency rooms, outpatient facilities, and any other place where medical services are performed. The third and final party is the insurance company, or payer.

It’s the medical biller’s job to negotiate and arrange for payment between these three parties. Specifically, the biller ensures that the healthcare provider is compensated for their services by billing both patients and payers. We bill because healthcare providers need to be compensated for the services they perform.

In order to do this, the biller collects all of the information (found in a “superbill”) about the patient and the patient’s procedure, and compiles that into a bill for the insurance company. This bill is called a claim, and it contains a patient’s demographic information, medical history, and insurance coverage, in addition to a report on what procedures were performed and why.

More about Insurance

Let’s take a quick step back to talk briefly about the insurance process. Health insurance is insurance against medical expenses. Put simply, people with health insurance, sometimes called ‘the insured’ or ‘subscribers,’ pay a certain amount in order to have a degree of protection against medical costs.

Health insurance comes in a number of forms, including:

- Indemnity, or pay-for-service insurance, in which the patient may choose any provider they like. This insurance is typically costlier, but grants the insured person more flexibility. As healthcare prices rise, indemnity insurance is becoming less and less popular.

- Managed care organizations (MCO): This is a blanket term that includes organizations like Healthcare Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Patients have fewer options as to which providers they can see, but their premiums and deductibles are fixed and are generally lower. Essentially, managed care insurance restricts patient’s options but also lowers the cost of having health insurance. This is the most popular form of health insurance in the United States today.

- Consumer-driven health plans

- We’ll look more at health insurance in just a bit, and we’ll look even deeper into the insurance claims process later on.

With each of these types of insurance, there are procedures and services that are covered, and some that are not. It’s the medical biller’s job to interpret a patient’s insurance plan (or plans) and use this information to create an accurate claim.

More About Claims

The creation of the claim is where medical billing most directly overlaps with medical coding. Medical billers take the procedure and diagnosis codes used by medical coders and use them to create claims.

Procedure codes, whether Current Procedure Terminology (CPT) or Healthcare Common Procedure Coding System (HCPCS), tell the payer what service the healthcare provider performed. Diagnosis codes, documented using ICD codes, demonstrate medical necessity. In other words, procedure codes tell the what of a patient’s visit, and the diagnosis codes tell the why.

The biller adds information about the patient and the patient’s visit, along with the cost of the procedure or procedures performed, to the claim. So the claim now has a what, a why, a who, a when, and a how much.

At this point, the biller also checks to make sure a claim is compliant. That is, the claim is factually and formally correct. This is a complicated process, as the biller must know what the claim allows so that the payer can fully evaluate the procedure and decide how much they will reimburse the provider. If the claim is approved, it’s sent back to the biller with the amount the payer is going to pay. The biller then takes the amount, called the balance, and sends it on to the patient.

Day-to-Day Activities

Now that you’ve got a little more information about the overall process, here’s a quick look at the day-to-day activities of a professional medical biller.

Working with Patients

- When a patient receives medical services from a healthcare provider, they’re typically presented with a bill at the end of their services. The biller creates this bill by looking at the balance (if any) the patient has, adding the cost of the procedure or service to that balance, deducting the amount covered by insurance, and factoring in a patient’s copay or deductible.

- Billers also work daily with a patient’s medical records. Where coders use medical reports to accurately translate medical services into code, billers abstract information from patients’ medical records and insurance plans to create accurate medical bills.

Working with Computers

- Today, almost every doctor’s office in the country uses some form of practice management software. This software keeps track of patients, helps schedule visits, stores important medical information and generally helps the practice run smoothly.

Creating Claims

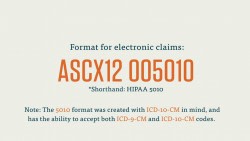

- The majority of a medical biller’s day is spent creating and processing medical claims. Billers need to be familiar with what type of claim an insurance payer accepts, and adjust their claim creation accordingly. Billers may also work frequently with insurance clearinghouses to streamline the claims process. Billers also have to check that each claim is compliant. Ideally, every claim a biller sends out will be “clean.” A clean claim contains no errors, and will be processed speedily by the payer, ensuring that the healthcare provider gets reimbursed quickly and efficiently.

Notification and Communication

- A biller is constantly in communication with insurance payers, clearinghouses, providers, and patients. Since the biller acts as the waypoint for the reimbursement process, they frequently have to clarify and follow-up with all parties of the healthcare process.

- Billers also explain and notify patients of their bill. Billers are in charge of issuing Explanations of Benefits (EOBs) to patients, which list which procedures are covered by the payer and why.

- Billers must also follow up with patients about paying the balance on their medical bills.

Collections

- In the case of a patient with delinquent bills, a medical billing specialist may have to arrange for collections on that debt. This is not necessarily a “day-to-day” activity, as one would hope that a provider’s patients were not ignoring their medical bills on a daily basis, but it is something to be aware of.

In the courses that follow, we’ll learn more about the steps of the medical billing process, the insurance claims process, Medicare and Medicaid, and HIPPA.